The Economics of Success

How much money does it take to be successful for each generation?

Taking a break from the usual technical articles I post here, I want to share some thoughts about personal finance and retirement (highly relevant to everyone!).

I was scrolling Twitter this morning and came upon this Tweet:

I’ve been thinking about crazy Gen Z salary expectations.

— Michael Girdley (@girdley) February 18, 2025

This was big a little while ago.

In case you missed it — here’s what different generations consider a “successful income”: pic.twitter.com/P9aFlwRKzO

The comments were filled with things like:

- "Impact of social media"

- "I don't blame Gen Z for being so clueless: they grew up with influencers flexing in front of (rented by the minute) jets and Lambos"

- "Gen Z hasn't been scarred by a real downturn"

- "Good. Dream big."

- "I blame success porn on IG"

- "I have some Gen Z employees

I don't get them."

The general consensus was that GenZ is greedy.

At first, I was going to write a comment on how financial perceptions are really what may be to blame here since what each generation begins their career planning for is impacted by inflation. I even pulled out Excel and did some quick calculations. Of course, each generation has likely adjusted their goals somewhat, but that doesn't change the fact that each generation's perception of the value of money doesn't keep up with inflation.

I could have left it at that but I decided to look into the "study" (very generous use of the term) and learn more about the methodology. Turns out the survey question was phrased like this: "Thinking about an annual salary (e.g., the money you earn at a job per year) and an 'all in' dollar amount (e.g., your overall net worth), how much money would it take for you to be financially successful?"

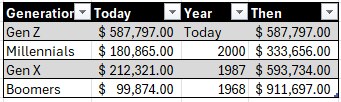

The results were this:

I've got to assume that the successful net worth is at retirement. I wish the question would have been more specific on this. As a GenZ, finding $10m in my bank account tomorrow wouldn't completely change my life. If you're my age, it shouldn't completely change yours either. I'd be able to retire early probably if I invested it well, and it would accelerate some financially dependent goals, but that's not "retire in your 20s" money. Getting $10m right now as someone in their early 20s would be life-changing, but my lifestyle and plans would have to stay mostly the same, or else I'd quickly be broke.

So either all of the survey respondents are delusional and underestimate how much it would cost to be "rich" for the rest of their lives, or they're saying that's how much they want to retire with.

If I, as a GenZ, retire with $10m, would I be rich? Are we being "clueless," "dreaming big," "entitled," or "influenced by 'rich' social media influencers," as Twitter seems to think? To answer that question, I've opened up Excel, put my MBA to work (NPV anyone?), and done the math to determine the economics of success. Let's think of this like financial Myth Busters. 💵💥

Let's assume a few things:

- Inflation is 3% per year—it could end up being more, or it could be less.

- It is currently 2025—unless you're reading this later, which, in that case, how are things going? 🔮

- The cost of retirement today is $59,000 per year per person, using Tennessee as an example. There are potential economies of scale benefits if you're married, so your actual expenses may vary.

- The life expectancy for females overall is 80 (males are slightly lower)

That gives us some interesting numbers...It turns out $10m will be worth about $2.5m of today's money when GenZ retires, which aligns closely with Millennials, both of which are less than GenX.

| Generation | Retirement Year | Net Worth Goal | Inlfation Adjusted Values at Retirement |

|---|---|---|---|

| GenZ | 2070 | $9,469,847.00 | $2,504,193.31 |

| Millennials | 2054 | $5,638,205.00 | $2,392,551.78 |

| GenX | 2038 | $5,295,072.00 | $3,605,686.37 |

| Boomers | 2020 | $1,047,172.00 | N/A |

Doing some more math, using Tennessee's retirement cost inflation-adjusted 10 years into retirement for each generation gives us:

| Generation | Annual Burn Rate 10y In | Years Budgeted |

|---|---|---|

| GenZ | $299,846.77 | 31.58 |

| Millennials | $186,854.59 | 30.17 |

| GenX | $116,441.60 | 45.47 |

| Boomers | $68,397.17 | 15.31 + 5 |

Since our average Boomers retired in 2020, they're already at least 5 years in. That means they budgeted about 20 years (or 25 if married), GenX 45 years, and both Millennials and GenZ 30 years.

But wait! Boomers must, on average, all think they're super successful because the average net worth of those 75+ is $1.62m and 65-74 is $1.79m (significantly higher than the "successful" net worth reported in the survey). Even if you say, Mackenly, that's the average, not the median, well, by any definition of "successful," the median isn't successful. If that's the case, the average successful Boomer has 25-30+ more years budgeted, putting them right in line with or exceeding GenZ and Millennials.

So, if you're paying attention, a clear pattern is emerging: Each generation is budgeting at least 2x the average lifespan. I'm also using Tennessee for the cost of living, which is on the low end, inflating the budgeted years, depending on where you live. This 2x multiplier is likely because finances are often shared between a couple, but the cost of living indexes are per person. There are some cost reductions when you share fixed costs, but overall, the numbers line up. You should aim for budgeting at least 30 years of expenses on average if you're married and share finances. And that's the absolute minimum (kudos to GenX for planning ahead).

So, what does this mean?

The incredibly poor understanding of finance and inflation by the commenters is concerning. It turns out that GenZ needing $10m at retirement isn't excessive at all. It surprisingly lines up very closely with the goals of every other generation in the survey and is less than what Boomers and GenX have budgeted for themselves.

If my assumption is wrong and this isn't what each generation wants for retirement at 65 and is instead what they think they could retire with today, then they're all delusional.

The key takeaway here is that inflation is a really big deal. If you're GenZ and hope to retire with $10m, you won't be rich. You'll simply be meeting the estimated cost of living, and that's assuming modest inflation. So, good luck.

Financial planning is often biased by how hard it is to understand compounding changes. It truly is hard to understand, which is why, every so often, it's a good idea to open up Excel and start thinking through things.